Indices trading conditions

Go long or short on the latest index opportunities

Trade top industry and economic benchmarks across global markets. Indices allow you to trade a group of securities that represent a segment of the overall market. With Neo-Ki’s competitive pricing, you can take advantage of movements in major world indices, including S&P 500, NASDAQ 100, DAX 40, and VIX.

The spread of a CFD is the difference between the 'bid' (buy) and 'ask' (sell) price of an instrument. This is the only cost charged to you when trading indices with Neo-Ki.

When trading indices with Neo-Ki, you can use leverage to multiply your overall exposure to the market without committing additional capital up front. Leverage can multiply the outcome of your trades.

Spreads and Conditions

| Symbol | Typical Spread | Max Leverage |

|---|---|---|

| US30 | Dow Jones | 2.6 |

| GER40 | DAX | 1 |

| US500X | S&P 500 | 0.42 |

| NAS100 | NASDAQ | 2.2 |

| UK100 | FTSE | 0.9 |

Get trading with Neo-Ki in 3 easy steps

Get trading with Neo-Ki in 3 easy steps

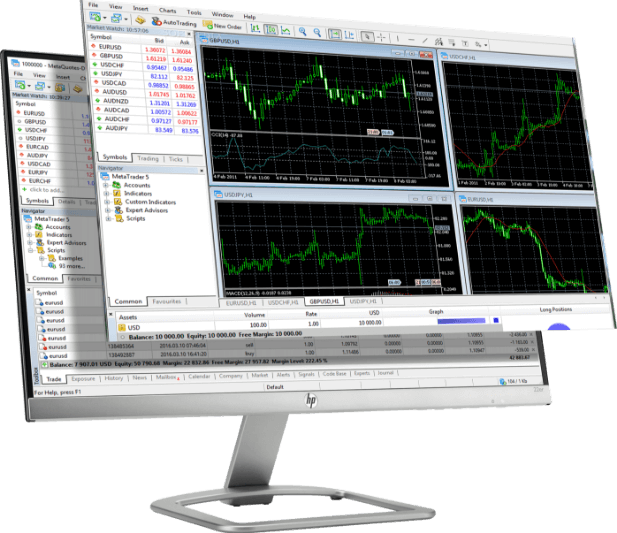

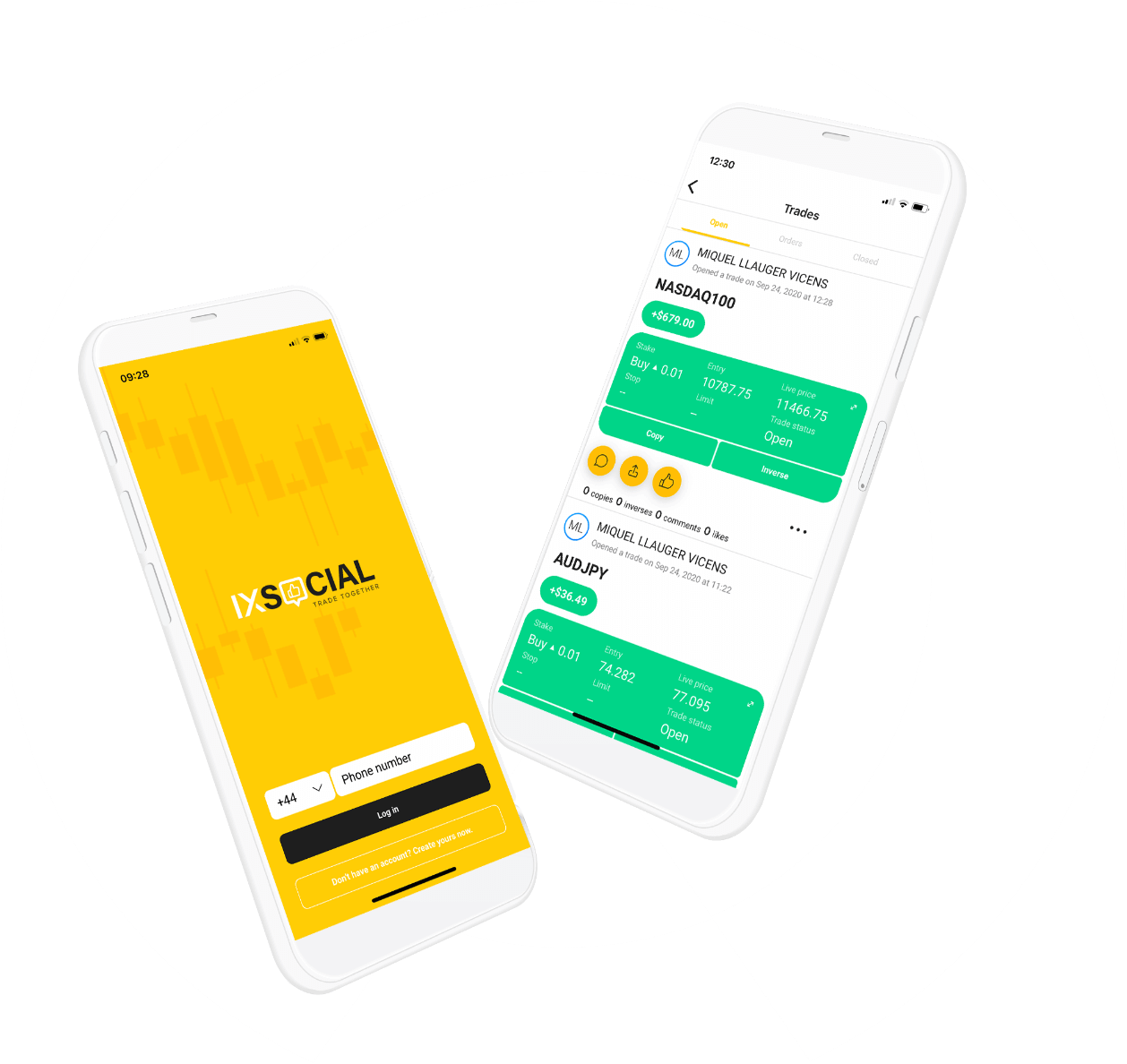

Platforms that are designed to deliver

Gain access to MetaTrader 4 and 5, trusted by traders across the world. Prefer to copy-trade instead? Auto-copy pro traders with ease through Neo-Ki.

Why trade indices

Trade entire markets, expand the scope of your trading, and diversify your portfolio, all in one move.